This article appeared in the South Carolina Association of CPAs. A version of this article appears in the Q1 2019 edition of South Carolina CPA Report magazine.

The democratization of data-gathering and advanced analytics has arrived. What exactly does that mean for firms?

Data and analytic democratization is more than Bank Rules inside of QuickBooks Online, or the Optical Character Recognition that automates data entry for Receipt Bank or AutoEntry. Ignore the myths that “bots” and AI are going to steal our jobs. It is true that those technologies will become more common inside of firms and that lower-level accounting tasks will become automated, and thus our service offerings will need to shift to higher-value advisory services.

Financial forecasting, cash flow management, KPI development, dashboarding, business strategy development and the like are all higher-value services. But they’ve been historically difficult to automate for any combination of reasons: the data was not digital, the data was siloed, the data was disparate, cognitive ability was required or the automation required coding.

Fortunately, the landscape has changed. Software services have moved to the cloud in all areas of business, not just accounting. Greater data connectivity has become possible and has helped solve the problems of digitization, siloed data and the connectivity between disparate data. Still, in the olden days – aka, a few years ago – you would need a developer or development skills to connect the data living in your cloud software.

No more.

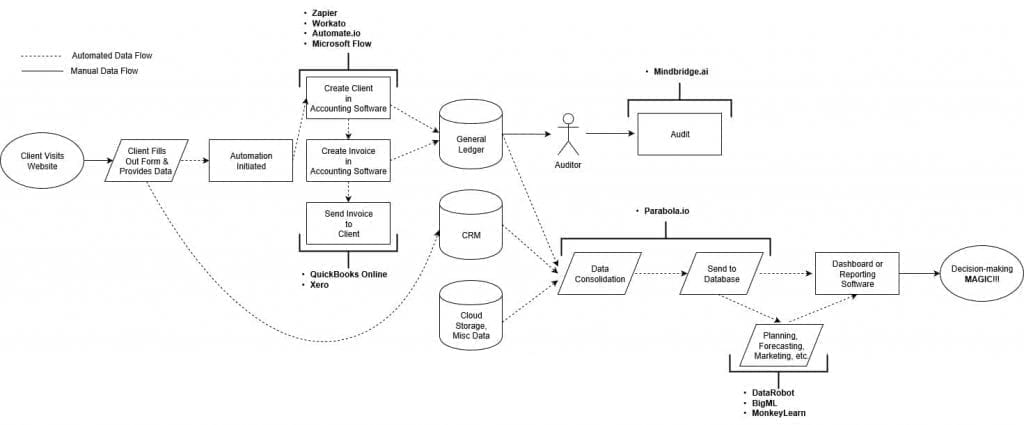

Services such as Zapier, Workato, Automate.io, Microsoft Flow and Parabola.io have democratized the connections (see the chart below, which you can click to enlarge). You no longer need to be able to code to connect these data sources, and that means you no longer have to procure a developer.

Services such as Mindbridge.ai in auditing, and DataRobot, MonkeyLearn and BigML more broadly in machine learning, now allow people with zero coding experience to build and deploy advanced predictive algorithms. This type of technology is allowing even the smallest of firms to get in the game.

At a prior company, I worked on a project to better predict costs and outcomes related to services we provided. We had a fair amount of data, but not nearly the analytic resources we needed, so we explored DataRobot.

DataRobot essentially allows you to drag and drop a dataset into their cloud-based program, click start, and it will iterate through and score hundreds of machine learning algorithms and tell you the best one. Then, you can deploy that algorithm into your workflow via an API. Pretty slick, and anybody can do this.

We gave the same dataset to a member of our advanced analytics team and told him to try his best. He devoted one full day and came up with one model. Then, on a conference call with DataRobot, we gave them the same dataset. In 20 minutes and no data manipulation, they scored hundreds of models and provided us with the best one. Oh, and that model was 30% more accurate than the one we produced in-house.

There are two reasons why it is critical to respond to these trends.

First, these technologies are being implemented by our clients in their businesses. That trend that will neither change nor slow down. It is reasonable to assume that our clients will expect us to implement similar technologies on the finance and strategy side. As I noted above, all things data and analytics are being democratized, which brings these types of services into the reach of even the smallest practitioners. Firms must get started on this, sooner rather than later.

Second, consider succession planning within the profession. A July 2018 article in CPA Practice Advisor notes that the AICPA estimates 75% of CPAs will retire in the next 15 years. Many firm owners are baby boomers, who overall are retiring at a rate of 10,000 per day. This means a lot of firms eventually will change hands, whether through merger, sale or something else. Millennials and Gen Zers who will take over these firms are technology natives, and they will expect the technologies listed above or substitute technologies will be in place by the time they make an offer. Otherwise, they will not be interested and will look elsewhere. We are already seeing this in the profession. Firms need to have a plan in place for this, and they must get started sooner than later.

Now that data workflows and advanced analytics are democratized, non-tech savvy CPAs in even the smallest of firms will be able to provide services on the back of these technologies. It means our clients will expect us to do so, because these same technologies will be deployed in the software they use in their businesses. Failure to do so will suppress the value of CPA firms and make succession planning extremely difficult.

Our profession is going to see a large demographic shift in the coming years. Firm owners and decision-makers must start planning and implementing now.