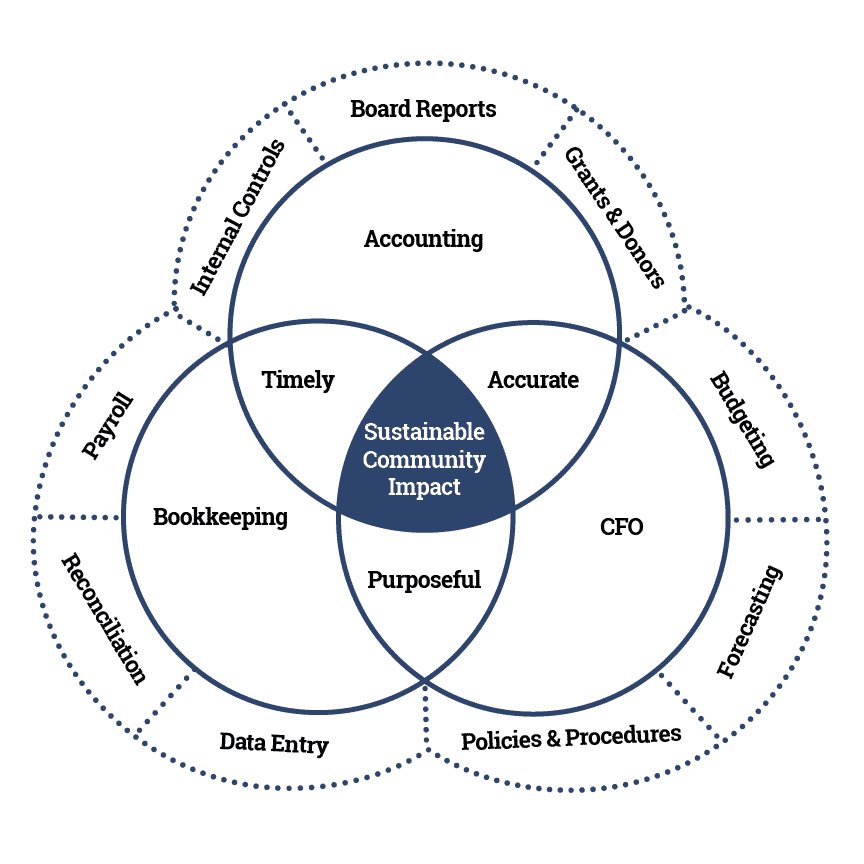

Make informed decisions that lead to a sustainable community impact

Many nonprofit organizations start without considering financial management. They depend on volunteers or hope that a board member is a CPA. Then, several months later, they find themselves without an accountant and the knowledge to keep the nonprofit in financial compliance.

At Chris Hervochon, CPA, CVA, LLC, our experienced team combines the three most important pillars of financial management — bookkeeping, accounting and CFO services — for the cost of a small salary. Here's why this matters:

We become part of your team and remove the stress of having to fund and staff a finance department.

We understand how one donation or one grant could mean shutting your doors.

We keep nonprofits compliant with accounting and financial reporting standards for nonprofit organizations.

We serve as advisors, working side-by-side with executive directors.

We manage and forecast cash flow.

We can help tell the right story about your nonprofit, including presenting complex financial data to the board of directors.

Pricing of Nonprofit Accounting Services

For most small businesses, professional financial management is nice to have. For nonprofits, however, professional accounting is a must have.

Accounting

- 10 Virtual Financial Review Meetings a Year

- Unlimited E-mail Support

- Bookkeeping via QuickBooks Online

- Accounts Payable Management

- Business Income Tax Return

- Accounts Receivable Management

- Accrual Based Accounting

- Employee Expense Reports

- Grant Tracking

- Industry Benchmarking Analysis - 1x Year

- Internal Controls Review - 1x Year

- Monthly Board Reporting Package

- Payroll via Gusto

Growth

Includes everything in Tier 1, plus:

- Unlimited Virtual Financial Review Meetings

- 1099 Filing and Distribution

- Advanced Analytics Dashboard

- Annual Budget

- Assistance With Custom Automation

- Client Leadership Team Meetings - 2x Month

- Donor Tracking & Donor Letters

- Financial Forecasting

- Policies and Procedures Review - 1x Year

Transformation

Includes everything in Tiers 1 & 2 plus:

- Capital Expenditure Planning

- Client Leadership Team Meetings - Weekly

- Employee Compensation Planning

- Federal Grant Compliance

- Interface With External Auditors

- Strategic Planning

- Statement of Functional Expenses Preparation

Fulfill your mission with a virtual CFO specializing in nonprofits

Our team combines bookkeeping, accounting and advisory into one role. No more filling a job position or depending on volunteers who may or may not have all of the necessary experience.

Nonprofits often lack the necessary internal controls needed as part of their financial reporting. We will work with your organizations to establish appropriate internal controls.

Chris Hervochon, CPA, CVA, LLC knows what nonprofits need — fundraising, donors, internal controls, policies and fraud controls. We make it easier to communicate with the board of directors about what your nonprofit organization is doing and why. Our services include grant tracking, donor tracking, and regular board meeting presentations.

FREQUENTLY ASKED QUESTIONS

Let's see if we're a good fit together. Book a free 45-minute Discovery Call with Jeff Byington, our business development representative, by clicking here.

Our team has experience overseeing nonprofit budgets in excess of $14 million.

We work with professionals from all over the United States, and occasionally even international clients. Our clients range from Rhode Island to Florida to California and everywhere in between.

It can take 60-90 days to optimize your QuickBooks centric system and customize your reporting package. 60-90 days is the "steady state,” but you will start seeing value right out of the gate.

We will never send you an invoice apart from your monthly subscription, unless something is obviously out of scope. However, even in such circumstances, you'll know what to expect before you get the invoice.

You will have at least two dedicated team members, who will be handling all of the bookkeeping, accounting and financial reporting for your account. More info about Better Way CPA's team can be found here.

Our goal is always to serve our clients using the most efficient programs available. That's why we use QuickBooks as our preferred accounting platform. When it comes to payroll, our preferred programs are Gusto or Rippling. For accounts payable management, we use Melio or Bill.com.

Yes, part of the onboarding services will include organizing your QuickBooks Online file.

- Each client's financial statements go through two levels of “human review” each month, with a cumulative 64-point review checklist.

- Bots. Lots and lots of bots. We deploy about a dozen automated proprietary bots in order to proactively check for anomalies within your books on an ongoing basis.

We use Gusto, a payroll platform that helps businesses like yours onboard, pay, insure, and support your hardworking team. For more information, please visit gusto.com.

Simply put, we compare your nonprofit's financial results with those of your peers. In some instances, we can compare your nonprofits to those in the same industry, in the same state, and with relatively the same size. This analysis helps to quickly identify where and why you need to make adjustments in your business to become more profitable.