Virtual accounting services are changing how people do business

At some point, business owners weigh their options between hiring an additional staff member or outsourcing. Many companies choose to outsource their accounting needs instead of filling an in-house position. Outsourced accounting offers a scalable solution for such integral processes as bookkeeping, payroll, financial reporting, data analytics and more.

Startups primarily outsource their accounting and bookkeeping functions. Accounting is mostly a scorekeeping function — classifying and recording transactions and generating financial reports based on data points that happened in the past. My mission is to bring a future-focus to accounting by combining traditional accounting services with data analytics, dashboarding and strategic advice.

Accounting by any other name ...

Not all accounting services are created equal, and “accounting” is a fairly generic term which can mean or refer to services such as:

- Bookkeeping

- Accounting

- Outsourced Accounting

- Client Accounting Services

- Outsourced Controller

- Virtual Controller

- Outsourced CFO

- Virtual CFO

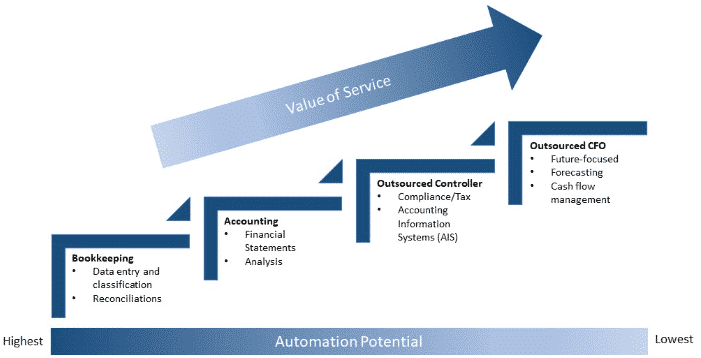

Of the above, “accounting”, “outsourced accounting” and “client accounting services” are catch-all terms. In reality, there are four distinct classifications of services in the value chain of accounting/outsourced accounting/client accounting services.

Are you ready for outsourced accounting?

Take a brief assessment to find out if your business could benefit from Outsourced Accounting.

Virtual Accounting Services for Small Businesses

Pricing for accounting services can vary wildly depending on the financial professional who is providing the services, taking into account such factors as qualifications and experience, as well as what services are provided.

The services many small businesses require include:

- Providing accounting software subscriptions (e.g. - QuickBooks, Xero, mobile apps, etc.)

- Cash or accrual accounting

- Accounts Payable (AP) management

- Accounts Receivable (AR) management

- Financial reports (P&L, Balance Sheet, Cash Flow Statement, AP Aging, AR Aging, ad hoc, etc.)

- Account Reconciliations

- Tax Preparation

Virtual CFO Services for Small to Midsize Businesses

As businesses grow, they find a greater need for a full menu of financial services. Small to midsize businesses and even large corporations hire Virtual Chief Financial Officers (CFOs) for:

- Budgeting

- Forecasting

- Cash flow management

- Assessing financing options

- Financial and corporate strategy

- Risk management, including insurance

- Talent acquisition, technology management and software consulting

- Building and/or implementing software automation

- KPI development

- Dashboarding

- Financial Review Meetings

- Tax Planning

- Sales and Use Tax Management

- Payroll, Time Tracking and Expense Reports

Additional Resources on Virtual Accounting

- National Society of Accountant’s Income & Fees Survey

- YouTube: What Does Outsourced Accounting Cost & Why?

- At what stage should a new startup get an accountant?

- For a small business, what are the pros and cons of Bench accounting versus QuickBooks?

- YouTube: What is Cloud Accounting and why is it awesome?

- YouTube: What is Outsourced Accounting?

- YouTube: The Benefits of Outsourced Accounting vs. Doing It Yourself

- What should business owners ideally handle on their own in accounting and when should they seek CPA services?

- What is a dashboard?

- What are the signs of a good accountant?

How to drive down the costs of outsourced accounting?

The more complex and nuanced the services, the higher the fee is going to be. There are only four ways to drive down the cost of accounting services:

- Use cheaper labor

- Heavy automation

- Heavy standardization across clients/service offerings (i.e. - spend less time)

- Some combination of the above

Other determining factors that affect the price of outsourced accounting

As you move up the value chain, and/or as you add services from the aforementioned menu, you will likely pay an increased fee for the services you receive. That fee will also fluctuate based on:

- Your geographic area

- The credentials of the service provider

- The experience of the service provider

Other factors that will influence price is whether or not the service provider is niched. If you own a marketing agency, would you rather receive accounting services from a professional who specializes in marketing agencies or a generalist? You’re likely to pay more for the former, but you’re also likely to receive much more value in the form of deeper insights.

Take into consideration how much of your accounting workflow can be automated off the shelf, automated with custom integrations in software, or not able to be automated at all — which means more human labor is involved.

What you can expect from outsourced accounting

Chris Hervochon, CPA, CVA takes over your accounting and finance functions so you can take over the world. On-going monthly services range from simple bookkeeping to virtual CFO services. Services can include:

- Dedicated and secure client portal

- 24/7 online access to financial statements (balance sheet, profit & loss statement and cash flow statement)

- Accounts receivable (A/R) management

- Accounts payable (A/P) management

- Bank & credit card reconciliation

- Fixed asset tracking

- Sales tax tracking and compliance

- Key predictive indicator (KPI) tracking via an online interactive dashboard within your secure client portal

How to get started with Chris Hervochon CPA

STEP 1:

Take the brief online assessment to determine if outsourced accounting is right for you.

STEP 2:

I will email you a customized report based on the information you provided in the assessment.

STEP 3:

Schedule a free consultation using the link at the bottom of the report. On this call, we will build a customized solution based on the challenges your business is facing.

The Benefits of Outsourced Accounting

For small businesses, outsourced accounting is an ideal and scalable solution that generally:

- Reduces overall costs, including costs of additional employees

- Operates more efficiently

- Develops better financial intelligence using cloud technology

- Understands your numbers for smarter business planning

A professional and trusted outsourced accountant can play multiple roles in the financial management aspect of your business:

- Bookkeeper

- Accounts payable and receivable

- A virtual Chief Financial Officer (CFO)

- Tax preparation and planning

- Audit support

What role does Cloud Accounting play in outsourced accounting?

One of the greatest benefits Cloud Accounting brings to the table is 24/7 access to real-time (or near real-time) data. An outsourced accountant who utilizes Cloud Accounting will set your business up with a secure online accounting system, such as QuickBooks, and then utilize automation to deliver greater financial reporting capabilities and insights.

Because Cloud Accounting applications are often associated with sensitive data, such as banking and other financial information, security is a major priority. In fact, unlike traditional desktop accounting software, which is at risk of being lost, damaged, or stolen, the cloud was designed to help eliminate these type of risks.

Some main benefits of Cloud Accounting software include:

- Data can be accessed in real time - Business owners can make the quickest and most informed decisions with easy, 24/7 access to financial data.

- An easy forum for collaboration - The easy-to-use interfaces and simultaneous access afforded by Cloud Accounting programs allow even the technologically challenged to quickly run a profit and loss statement or see whether a client has paid an invoice. This financial control opens the dialog for better communication with your outsourced accountant.

- Automated bookkeeping and accounting features - Outsourced accountants used Cloud Accounting to increase efficiency by automating repetitive tasks, such as coding regular, known expenses. With Cloud Accounting, financial information transfers directly from various bank accounts into the software.

- Cloud Accounting scales to fit your growing business - Anytime your business experiences unexpected growth, you can rest assured knowing your outsourced accountant's Cloud Accounting ecosystem can support your growing business.

- Increases cash flow - Cloud Accounting software yields a higher potential for automation, which means less time spent on mundane tasks by you or your employees. The result is less overall cost to your business and a high ROI.

- Integrate with other cloud solutions - Cloud Accounting software allows for inter-app connectivity that enables you to sync with other cloud solutions, such as mileage tracking, time tracking, receipt capture and bill payments.

Who should use an outsourced accountant?

Outsourced accounting is ideal for business owners who want and need a consistent stream of quality financial information, but without the cost of hiring a full-time staff and implementing a complicated accounting & finance infrastructure.

However, there are situations that trigger the need for outsourced accounting. For instance, self-employed or one-person businesses don’t think about accounting until their business grows. Then, they don’t have time for bookkeeping and need a professional to keep a closer eye on their finances. In a nutshell, they need more than what a bookkeeper can provide — including such services as financial reporting, cash flow management, payroll, tax returns, and data analytics.

On the other hand, small to midsize businesses with a staff of more than 10 people and revenues of $1 million or more can benefit from outsourcing their accounting function too. An outsourced accountant can help automate the accounting function, consult on software and processes and provide support for financial reporting and external audits. An outsourced accounting firm can help internal processes reach financial peaks.

The most important thing is to find an accountant that you will work well with and who can be a strategic partner. A good accountant is worth their weight in gold, and will likely pay for themselves in the advice they give to help you grow your top line, identify areas of bloated expense and tax savings. It doesn’t matter what price you pay for the services you receive, what matters is the value you receive from the services.

Interested in outsourced accounting services?