So what is a KPI? KPI stands for Key Performance Indicator. There are many different types of KPIs – financial, operational, marketing, etc. Sure, financial statements are great, but they’re difficult to digest. KPIs are byte-sized metrics that you can use which indicate what’s going well (or not) in your business.

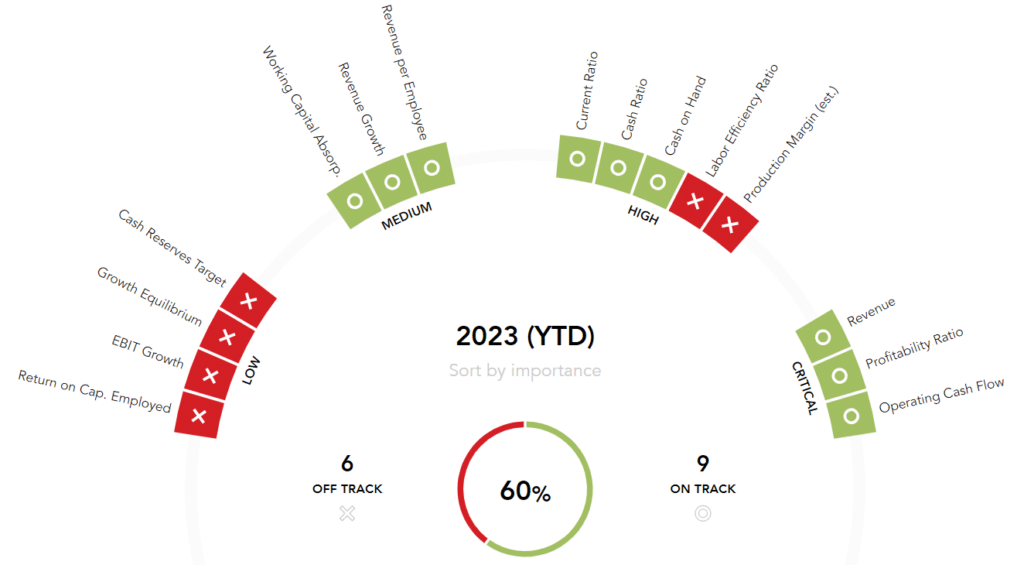

Recently, we moved our financial reporting and forecasting platform to Fathom. During financial review meetings with customers, we like to look at a chart like the one below with our customers. A chart like the one below helps us prioritize the problem areas – we work right to left and find the first problem – and then strategize how to move the business forward.

For the purpose of this blog post we will talk about how we arrive at the goal for each KPI, not the specific numbers we target as every agency is unique. Not only are all agencies unique, but one agency might be in a different stage of their lifecycle, or the owners might have different goals, than another agency.

Need help figuring out the specific targets for your agency? Let’s start a conversation.

Without further ado, here are the 15 financial KPIs we track for our marketing and creative agency customers:

1. Operating Cash Flow

What is it? – Operating cash flow is simply the cash generated by the operating activities of the business. Operating activities include the production, sales and delivery of the agency’s services, as well as collecting payment from its customers and making payment to vendors.

Importance – Critical

What is the goal? – Budgeted operating cash flow

2. Profitability Ratio

What is it? – A measurement of the proportion of revenue left over after deducting all expenses. This excludes finance costs and tax expenses. The profitability ratio can be further improved by improving price, volume, cost and expense management.

Importance – Critical

What is the goal? – Budgeted profitability ratio

3. Revenue

What is it? – A measure of the total amount of money received by the company for goods sold or services provided. If you don’t have revenue, you don’t have a business. Strategies to improve revenue may include increasing prices, increasing the volume of sales through marketing initiatives, or finding alternative sources of income.

Importance – Critical

What is the goal? – Budgeted revenue

4. Production Margin

What is it? – This is the amount of revenue you get to keep when considering variable costs to deliver the revenue, as well as the attributable labor expense.

Importance – High

What is the goal? – 55%. Want to know why we suggest such a precise number? Check out this video for the full context and analysis.

5. Labor Efficiency Ratio

What is it? – This is a measurement of the productivity of the people in your business. It’s also an indicator of how sustainable your labor expense is relative to your revenue.

Importance – High

What is the goal? – The industry benchmark

6. Cash on Hand

What is it? – A measure of the cash and cash equivalents in actual possession by the company at a particular time.

Importance – High

What is the goal? – Budgeted cash on hand

7. Cash Ratio

What is it? – The Cash Ratio measures the availability of cash and cash equivalents there are to cover current liabilities. Few businesses have sufficient cash and cash equivalents to fully cover current liabilities. Accordingly, a cash ratio of less than 1 is often acceptable.

Importance – High

What is the goal? – The industry benchmark

8. Current Ratio

What is it? – A measure of liquidity. This measure compares the totals of the current assets and current liabilities. The higher the current ratio, the greater the ‘cushion’ between current obligations and the business’s ability to pay them. Generally, a current ratio of 2 or more is an indicator of good short-term financial strength. In other words, the current assets of the business should be at least double the current liabilities.

Importance – High

What is the goal? – The industry benchmark

9. Revenue per Employee

What is it? – This is the amount of revenue generated per employee for the given period. A larger amount is better as this is a measure of organizational efficiency.

Importance – Medium

What is the goal? – The industry benchmark

10. Revenue Growth

What is it? – A measure of the percentage change in revenue for the period. Management should ensure that revenues increase at rates higher than general economic growth rates (ie. inflation).

Importance – Medium

What is the goal? – Budgeted revenue growth

11. Working Capital Absorption

What is it? – A measure of the adequacy of working capital to support sales activity. This measure indicates the investment made in working capital for each unit of revenue. The trend of this ratio is particularly useful for growing businesses. If sales increase rapidly but working capital levels remain constant, the business may be at risk that insufficient working capital is available to support this growth. Moreover, if the result for this metric is greater than the Gross Profit Margin percentage, then for every additional unit of Revenue generated, additional cash will be required.

Importance – Medium

What is the goal? – The industry benchmark

12. Cash Reserves Target

What is it? – This is the amount of cash the business should target to keep, determined via the Better Way CPA Cash Reserves calculator amount, multiplied by last month’s fixed expenses. The target is the budgeted cash balance at the end of the year. The amount should be compared to the Cash on Hand KPI.

Importance – Low

What is the goal? – Budgeted cash reserves

13. Growth Equilibrium

What is it? – A measure of the self-funding rate of growth the business can sustain from its retained earnings (assuming a constant debt-to-equity ratio). The growth equilibrium is also commonly known as the sustainable growth rate. When the actual growth rate is less than the sustainable growth rate this indicates that the business has sufficient cash to fund its growth. When the actual growth rate is above sustainable, this indicates that only a portion of growth is being funded by retained earnings. Additional funding will be required from outside sources to fund the deficit.

Importance – Low

What is the goal? – The industry benchmark

14. EBIT Growth

What is it? – A measure of the percentage change in EBIT for the period. EBIT stands for “earnings before interest and taxes.” A combination of growth in revenues and growth in profits presents a balanced measure of growth.

Importance – Low

What is the goal? – Budgeted EBIT growth

15. Return on Capital Employed

What is it? – A measure of the efficiency and profitability of capital investment (ie. funds provided by shareholders & lenders). ROCE monitors the relationship between the capital (‘inputs’) used by the business and the earnings (‘outputs’) generated by the business. ROCE is arguably one of the most important performance measures. The higher the result the greater the return to providers of capital.

Importance – Low

What is the goal? – Budgeted return on capital employed

Conclusion

Why do we use so many budgeted numbers in tracking KPIs?

Because the budget is the roadmap. It’s how we get from “here” (wherever here is) to “there” (the goals you set forth with us for your agency). The budgeting process is very robust and collaborative. The result is the roadmap of how you will achieve the financial goals of your agency.

In conclusion, a proper set of KPIs that are tracked with the proper priority assigned to them can be a very effective tool to help you run a profitable agency. Assigning priorities allows us to tackle problems as they arise and to put out the biggest fires first.

Do you need help getting started?

Here are three ways we can help your marketing agency grow:

- Subscribe to our marketing industry e-newsletter

- Is your agency not as profitable as it should be? Check out our free “Agency Profitability Audit Framework” webinar.

- Let’s work together! Let’s start a conversation to see if we’re a good fit.