If I had a nickel for every time a client asked me about IRS audits, I would still have to prepare tax returns for a living, but I’d definitely be able to afford a round of Happy Meals for my kids. Everybody is terrified of an IRS audit, partly because they imagine an audit as an agent showing up at their door and rifling through their personal lives, similar to Will Ferrell in Stranger Than Fiction.

Here are four ways to get audited by the IRS.

Business Use of a Vehicle

This is a legitimate deduction, as I talked about on YouTube Live below.

However, you need to be careful. Apart from keeping a log and good records, if you report that your vehicle was 100% used for business you are likely to raise a red flag. To be clear, I am referring to a professional — such as an insurance agent — who drives the car to business appointments but also uses the car for personal errands and family time. Reporting higher usage of the car for business than a logical person would conclude is reasonable is a good way to get audited.

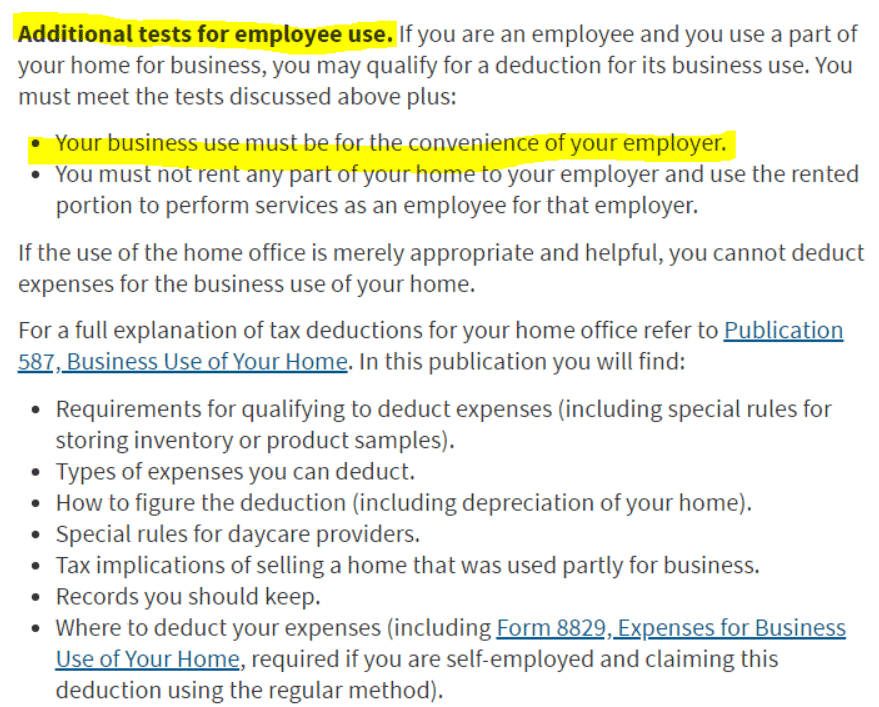

The Home Office Deduction

Also a legitimate deduction, the home office been limited after the Tax Cuts and Jobs Act (TCJA). As this article in Nerd Wallet points out, this is one of the deductions that will raise a red flag. You can take the deduction as an employee, but only if you work from home for the convenience of your employer.

If you own a business, the deduction is still available to you. Be careful to accurately calculate the square footage that is used solely as a home office, the total square footage of the house, and to only include legitimate expenses for maintaining the home.

Hobby Losses

As Kiplinger points out in this article, hobby losses are not deductible. If you are reporting a hobby loss masquerading as a business, you may have a problem.

How does the IRS know the difference between a business and a hobby? If you report multiple years of losses without ever showing a profit or if you can’t establish and document a profit motive, you’re going to have trouble. For a great, in-depth, discussion of this topic check out my friend Damien Martin’s Simply Tax podcast, episode #48.

Not Including All of Your Income

The vast majority of examinations conducted by the IRS, around 800,000 , are conducted via correspondence.

What does that mean and how does it happen?

When organizations file information returns with the IRS, including 1099s, and W-2s, the IRS’s computers match those informational filings with what you file on your tax return. If there’s a mismatch, the IRS will send you a notice.

For example, on occasion a client gets really excited to file their tax return early. Then, they receive a late 1099 in March or April. When the IRS’s computers compare the tax return with the informational return they received, they see a mismatch. This triggers an official notice to the taxpayer, heart palpitations, and then a call to the tax preparer (me). This doesn’t happen often, but it does happen.

The other instance is where the taxpayer knowingly forgets to include income on their tax return. Not a good idea.

How likely are you to get audited, really?

In reality, the odds of having an IRS agent show up at your door for an audit are really low. However, the odds for business audits are slightly higher than they are for individuals. For the 2016 tax year, the last year data is available, 196,000,000 (that’s million with an “m”) were filed with the IRS. Of those, only 0.5%, or about 1.1M, were examined. Of those, about 310,000 were field audits where you deal with the agent face to face. Further down the rabbit hole still, only 215,000 of those 310,000 were for personal returns.

Oh, and by the way … 34,000 of those examinations resulted in additional refunds to the taxpayer.

Already received a notice from the IRS?

Check out my below YouTube Live video which discusses penalty abatement strategies

To Summarize

While the odds of being examined by the IRS, let alone receiving a field audit, are really low, this doesn’t meanyou should be cavalier with your tax returns.

What it does mean is you should know what areas you need to know:

1) what deductions are available to you and

2) how to appropriately document and calculate those deductions.

Still need help?

When you’re ready ready, here are three ways we can help you grow.

- Subscribe to “Accounting for Marketing” e-newsletter featuring your industry’s latest headlines

- Join our growing Facebook group of marketing professionals

- Let’s work together! Let’s start a conversation to see if we’re a good fit.

I liked it when you said that if I had a nickel for every time a client asked me about IRS audits, I would still have to prepare tax returns for a living, but I’d be able to afford a round of Happy Meals for my kids. My friend has a business, and he said he had many headaches in tax planning. I will share constructive tips for him to get an idea on where to get tax prep grand rapids services.